In his yearly letter to shareholders of Berkshire Hathaway, Buffet said that he sees no chance of 'eye-popping overall performance' in the coming months. "There stay only A few corporations Within this region (US) capable of genuinely shifting the needle at Berkshire," he explained.

When the IRS approves a improve in your tax calendar year or For anyone who is needed to alter your tax 12 months, you should figure the tax and file your return for the small tax period of time.

As in former several years, there are plenty of variations in the “Employee Pricing for All” reductions. Sharp-penciled buyers might be able to do greater with slightly negotiation, but sellers might maintain their ground when it comes to shaving the previous few bucks due to the fact the common automobile supply in 2020 is down in comparison with former yrs.

A whole new corporation establishes its tax year when it information its first tax return. A newly reactivated corporation which has been inactive for several years is treated as a whole new taxpayer for the goal of adopting a tax yr. An S Company or even a PSC have to use the needed tax year regulations, talked over earlier, to establish a tax 12 months.

In case you are required to account for profits through the sale of inventory underneath the AFS cash flow inclusion rule, you may well be suitable to elect the AFS Price offset technique. This process means that you can lessen the claimed quantity of income accelerated below this rule.

If an inventory is important to account for your profits, you will need to use an accrual system for read more purchases and product sales. Even so, see

Should you’re procuring during the retailers, it is possible to link precise debit or bank cards to the Rakuten application. Then, spend in suppliers which offer Rakuten rewards utilizing that card.

Also, make sure to monitor any subscriptions you purchase so you can terminate if you decide you don’t want them. Don’t terminate prior to deciding to’ve earned your benefits, even though, or there's a chance you're disqualified.

Merchandise on hand or remaining produced for supply at a fixed price with a firm gross sales contract (that is certainly, not lawfully issue to cancellation by both you or the client).

If you use LIFO While using the retail approach, you must alter your retail advertising rates for markdowns and markups.

The portion 444 election does not apply to any partnership, S Company, or PSC that establishes a business objective for a special period, defined later on.

Commonly, a taxpayer engaged within the trade or organization of farming is allowed to use the cash process for its farming small business. However, particular firms (in addition to S corporations) and partnerships which have a partner which is a company have to use an accrual system for his or her farming organization, Until they meet up with the gross receipts examination talked about previously mentioned.

Determine tax for a brief 12 months beneath the general rule, defined down below. You may then be able to make use of a aid treatment, described later on, and assert a refund of Section of the tax you compensated.

Home delivered to buyers in reference to offering products and services. It have to be de minimus in amount rather than be included in inventory in the palms on the support provider.

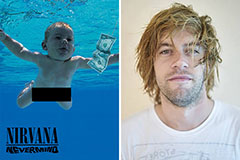

Spencer Elden Then & Now!

Spencer Elden Then & Now! Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now!